Happenings

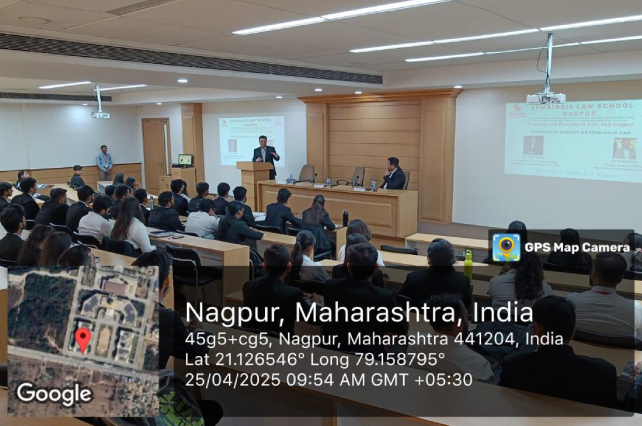

The Training & Placement Cell of Symbiosis Law School, Nagpur organized an Interactive session on Insurance Law on 25th of April 2025.

The Training & Placement Cell of Symbiosis Law School, Nagpur organized an Interactive session on Insurance Law on 25th of April 2025. The workshop was conducted by Mr. Amit Middha, Vice President and Head commercial claims, Bajaj Alliance General Insurance, alongside Mr. Prabal Dixit, Manager commercial claims, Bajaj Alliance General Insurance. The workshop commenced with the introduction & felicitation of the Hon’ble Guest Speakers.

Mr. Amit Middha started the session by providing attendees with a comprehensive overview of what is Insurance and how does Bajaj Alliance General Insurance help costumers along with certain aspects of insurance law. Explaining that Insurance is a contract of indemnity where insurers provide security for any unpredicted and unforeseen events and that the insurance is a promise in exchange of a premium from the customer where a pool of money is created from which the customer who needs compensation will compensate from. Explaining further that India’s GDP is 6.28% but the insurance sectors GDP itself is increasing and growing by the rate of 10-15%. Bajaj Alliance General Insurance is the biggest and largest private sector general insurance company in India and it started at operations on 2nd may 2001.

Mr. Prabal Dixit then delves further in the subject explaining the insurance is a contract, which is represented by a policy in which entities secure protection against unforeseen events. Insurance is of two types - life insurance and general insurance. Further in general insurance multiple insurances such as motor, nonmotor insurance, property insurance, liabilities, workman compensation etc. are covered. Mr. Prabal Dixit also explained what is the process of getting an insurance, where the consumer first describes what kind of policy he wants then He further describes the ailments and conditions of the main subject for which he is taking the insurance for, Further which the insurance company then gives the insured counteroffers with telling the price of premium that they would be charging with respect to all the ailments in the conditions described by the insured and as soon as the first Premium arrives to the insurer he is bound to pay in time of contingency.

He further explains what a floaters policy is - A floater policy is an insurance plan that provides a single sum insured to cover multiple individuals or items under one policy. It allows flexibility by sharing the total coverage among all insured entities, making it cost-effective and easier to manage than separate individual policies. He also explains that insurer and insured shall have upmost good faith towards each other meaning, that both the insurer and the insured shall fully disclose all important facts. It ensures honesty and transparency in the contract. If either side hides or lies about something important, the policy can be cancelled or claims denied. For example, if someone applying for health insurance hides their diabetes from the insurance company, and later files a claim for a diabetes-related issue, the company can reject the claim because the person didn’t follow the principle of utmost good faith.

He questions the Lisners about we proximate cause after which he explains that Proximate Cause is the main or most direct reason for a loss or damage in insurance claims. It helps determine whether the damage was caused by something covered under the insurance policy. Only if the proximate cause is covered, the insurance company will pay for the loss. Example - A storm hits a factory and blows off the roof. Because of that, rainwater enters and damages the goods inside. Here, the storm is the proximate cause (the first and most direct reason). Since storm damage is usually covered in property insurance, the insurance company will cover the loss to the goods too — because the chain of events started with a covered peril.

He further explains what is indemnity and subrogation, Indemnity means putting the insured back in the same financial position they were in before the loss — no better, no worse. The idea is to compensate, not enrich, a fire destroys ₹2 lakh worth of stock in your shop, the insurance company pays ₹2 lakh (if that’s your actual loss). You don't earn profit from it, just recover what you lost. Subrogation is a principle in insurance where; after compensating the insured for a loss, the insurance company gains the legal right to recover that amount from the third party responsible for the damage. This ensures the insured does not receive double compensation (from both the insurer and the wrongdoer) and helps the insurer recover its loss. Subrogation typically applies in cases like car accidents, fire damages, or third-party negligence. It maintains fairness by shifting the financial burden to the actual wrongdoer, not the insurance company, once the claim has been settled with the insured. It follows after indemnity is provided, if a truck hits your insured car and your insurer pays for the repairs, your insurer can then sue the truck driver to recover that money.

Further he explains that Insured Cannot Make a Profit Out of Insurance, Insurance is meant to compensate for a loss, not to make a profit. You can only claim the actual amount of your loss, not more than that. This ensures fairness and prevents people from using insurance for personal gain.

Being An interactive session Mr Prabhal Dixit questions the listeners on insurance laws and policies to test their knowledge, explaining how Cyber insurance work - Cyber insurance protects individuals or businesses from financial losses caused by cyberattacks, data breaches, or other digital threats. It covers costs like data recovery, legal fees, notification to affected customers, and even ransom payments in case of ransomware attacks. Businesses rely on it to manage risks in today’s digital world, If a hacker breaks into a company’s system, steals customer data, and demands ransom, cyber insurance can cover the cost of hiring IT experts, paying the ransom (if allowed), and handling lawsuits from customers. This helps the business recover without bearing the entire financial burden alone.

Further he explains that in India, insurance is mandatory in several sectors to ensure public safety, financial security, and legal compliance. Under the Motor Vehicles Act, 1988, third-party liability insurance is compulsory for all motor vehicles. For employees, the Employees' State Insurance Act, 1948 mandates coverage for establishments with 10 or more employees, providing benefits like medical care, disability, and maternity. Health insurance is not mandatory for individuals, but certain government employees are covered, and schemes like the Pradhan Mantri Jan Arogya Yojana provide health coverage to economically weaker sections. The Workmen's Compensation Act, 1923 requires employers to provide insurance for work-related injuries. Additionally, construction projects require Contractors' All Risk insurance, and Public Liability Insurance is mandatory for hazardous industries under the Public Liability Insurance Act, 1991. In sectors like aviation and marine, insurance is also compulsory for third-party liabilities, and banks may require insurance for mortgages or loans. These provisions aim to safeguard both individuals and the public from unforeseen risks.

Dr. Amruta Ballal, Training and Placement officer, Training and Placement Cell and TPC staff Members coordinated the event. The workshop was a grand success under the able guidance of our Director Dr. Sukhvinder Singh Dari Sir.